All Categories

Featured

Table of Contents

For making a minimal quantity of the index's growth, the IUL will never obtain much less than 0 percent passion. Even if the S&P 500 declines 20 percent from one year to the next, your IUL will not lose any type of money value as a result of the marketplace's losses.

Discuss having your cake and consuming it also! Imagine the rate of interest worsening on an item with that kind of power. So, offered all of this info, isn't it possible that indexed global life is a product that would allow Americans to buy term and spend the rest? It would certainly be tough to refute the reasoning, would not it? Currently, don't get me incorrect.

A true investment is a protections item that undergoes market losses. You are never subject to market losses with IUL merely since you are never subject to market gains either. With IUL, you are not invested in the marketplace, yet merely making passion based on the efficiency of the marketplace.

Returns can grow as long as you continue to make payments or keep a balance.

Index Life Insurance Vs Roth Ira

Unlike universal life insurance, indexed universal life insurance policy's cash worth gains interest based on the efficiency of indexed supply markets and bonds, such as S&P and Nasdaq., mentions an indexed universal life policy is like an indexed annuity that feels like universal life.

Universal life insurance coverage was produced in the 1980s when passion prices were high. Like other kinds of irreversible life insurance coverage, this plan has a money worth.

Indexed global life plans supply a minimum guaranteed passion price, also known as a rate of interest crediting floor, which minimizes market losses. State your money value loses 8%.

Equity Indexed Universal Life Policy

A IUL is an irreversible life insurance plan that obtains from the buildings of a global life insurance coverage plan. Unlike universal life, your cash worth expands based on the efficiency of market indexes such as the S&P 500 or Nasdaq.

Her work has actually been published in AARP, CNN Emphasized, Forbes, Fortune, PolicyGenius, and U.S. News & World Record. ExperienceAlani has assessed life insurance policy and pet insurance firms and has actually written various explainers on travel insurance coverage, debt, financial obligation, and home insurance policy. She is enthusiastic regarding demystifying the complexities of insurance policy and various other individual money topics to ensure that readers have the details they need to make the most effective cash decisions.

Paying only the Age 90 No-Lapse Premiums will guarantee the death benefit to the insured's obtained age 90 but will not assure money worth accumulation. If your client stops paying the no-lapse guarantee premiums, the no-lapse attribute will terminate before the assured period. If this takes place, added costs in an amount equivalent to the shortfall can be paid to bring the no-lapse attribute back active.

I recently had a life insurance policy salesman appear in the remarks thread of a post I released years ago concerning not mixing insurance policy and investing. He assumed Indexed Universal Life Insurance Policy (IUL) was the ideal point considering that cut bread. In support of his placement, he published a web link to an article written in 2012 by Insurance Policy Agent Allen Koreis in 2012, entitled "16 Factors Why Accountants Prefer Indexed Universal Life Insurance Policy" [link no more available]

Universal Life Insurance Calculator Cash Value

Initially a brief description of Indexed Universal Life Insurance Coverage. The destination of IUL is noticeable.

If the marketplace goes down, you get the guaranteed return, typically something between 0 and 3%. Naturally, given that it's an insurance coverage policy, there are additionally the typical expenses of insurance, payments, and abandonment fees to pay. The details, and the factors that returns are so terrible when blending insurance policy and investing in this particular method, boil down to generally three things: They only pay you for the return of the index, and not the rewards.

Is Universal Life Whole Life

Your optimum return is topped. If you cap is 10%, and the return of the S&P 500 index fund is 30% (like last year), you get 10%, not 30%. Some plans just provide a particular percent of the modification in the index, claim 80%. So if the Index Fund goes up 12%, and 2% of that is dividends, the adjustment in the index is 10%.

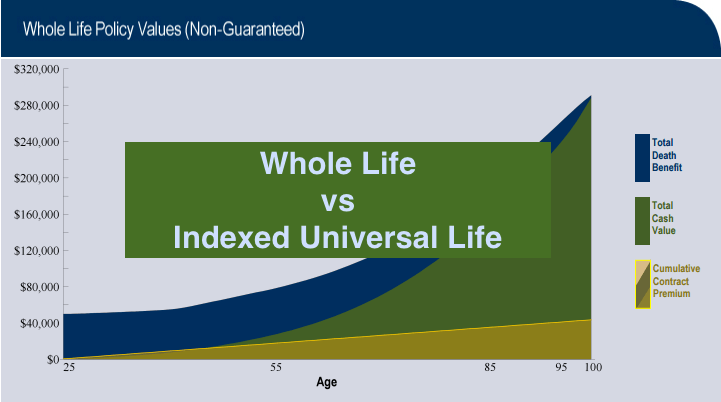

Include all these impacts with each other, and you'll locate that long-lasting returns on index universal life are rather darn close to those for whole life insurance policy, positive, yet reduced. Yes, these plans assure that the money value (not the cash that mosts likely to the prices of insurance, certainly) will certainly not shed cash, however there is no warranty it will certainly stay on par with rising cost of living, much less grow at the price you need it to expand at in order to give for your retirement.

Koreis's 16 reasons: An indexed global life policy account worth can never ever lose money due to a down market. Indexed global life insurance warranties your account worth, securing in gains from each year, called an annual reset.

In investing, you make money to take danger. If you don't want to take much danger, don't anticipate high returns. IUL account values expand tax-deferred like a certified strategy (IRA and 401(k)); common funds do not unless they are held within a certified strategy. Basically, this suggests that your account value advantages from three-way compounding: You make passion on your principal, you make rate of interest on your passion and you make rate of interest on the money you would otherwise have paid in tax obligations on the rate of interest.

Flexible Premium Indexed Adjustable Life Insurance

Although certified strategies are a far better selection than non-qualified strategies, they still have problems not provide with an IUL. Investment selections are generally limited to mutual funds where your account value goes through wild volatility from direct exposure to market danger. There is a big difference in between a tax-deferred retired life account and an IUL, but Mr.

You invest in one with pre-tax bucks, minimizing this year's tax costs at your minimal tax obligation rate (and will certainly often be able to withdraw your cash at a lower reliable price later on) while you spend in the other with after-tax dollars and will certainly be compelled to pay rate of interest to borrow your very own cash if you don't intend to surrender the plan.

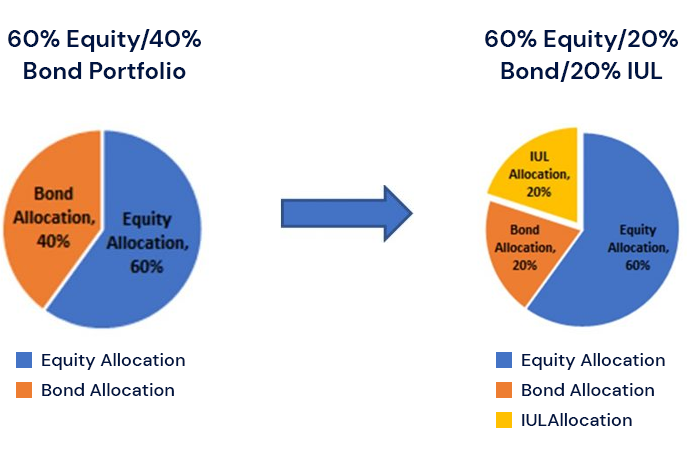

After that he throws in the traditional IUL salesman scare tactic of "wild volatility." If you dislike volatility, there are better ways to lower it than by purchasing an IUL, like diversity, bonds or low-beta stocks. There are no limitations on the quantity that might be contributed annually to an IUL.

That's comforting. Let's consider this for a second. Why would the government placed restrictions on just how much you can take into retired life accounts? Possibly, just perhaps, it's because they're such a lot that the federal government doesn't desire you to save too much on tax obligations. Nah, that could not be it.

Latest Posts

Universal Benefits Insurance

What Is A Flexible Premium Life Insurance Policy

Best Iul For Cash Accumulation